Disclaimer:

The content published on this website is provided for general informational purposes only. Articles are generated with the assistance of artificial intelligence and are reviewed periodically; however, accuracy cannot be guaranteed in all cases. Readers are encouraged to verify important information from reliable and authoritative sources before relying on it. The website does not intend to mislead, and any errors found will be corrected when identified.

In the realm of financing, understanding the distinctions between Islamic mortgages and conventional mortgages is crucial, especially for Muslims seeking to comply with Sharia principles while acquiring property. An Islamic mortgage, or Murabaha, is structured to align with the ethical guidelines of Islam, emphasizing fairness and transparency, while avoiding interest (Riba), which is considered haram, or forbidden. This approach fosters a collaborative relationship between the lender and the borrower, ensuring that both parties share in the risks and rewards of the investment.

At Airlink Hajj and Umrah, we recognize that financial decisions can be pivotal in fulfilling your dreams, whether it’s securing your family home or planning a sacred pilgrimage. Our blog is dedicated to providing you with all the latest updates on Hajj and Umrah, as well as insightful articles that can guide you through financial matters, including a deeper understanding of Islamic financing options. By choosing an Islamic mortgage, you not only invest in property but also uphold your faith and values. Join us as we explore the key differences and benefits between these two mortgage types to help you make informed decisions for your future.

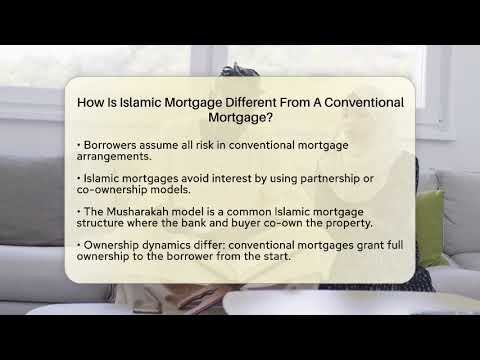

How Do Islamic Mortgages Differ From Conventional Ones?

Islamic mortgages, known as "Murabaha" or "Ijara," fundamentally differ from conventional mortgages primarily due to their adherence to Sharia law. Conventional mortgages involve interest payments, which are considered haram (forbidden) in Islam. Instead, Islamic finance principles prohibit interest and promote profit and risk-sharing, ensuring that all parties engage in ethical financial practices.

In a Murabaha contract, the bank purchases the property and sells it to the buyer at a higher price, allowing for installment payments over time without charging interest. Alternatively, in an Ijara agreement, the bank buys the property and leases it to the buyer, who eventually gains ownership. Both methods highlight a key characteristic of Islamic finance: the avoidance of risk-free profit.

Another distinguishing factor is the upfront transparency of fees and costs, which is crucial in Islamic finance. This ensures that all parties are clear on their obligations and can make informed decisions, aligning with the principles of fair trading and honesty.

At Airlink Hajj and Umrah, we provide all the latest updates and insights on Hajj and Umrah, including financial information relevant to your pilgrimage. Understanding these differences in mortgages can help you make informed decisions, whether purchasing a home or planning your sacred journey.

FAQ on “How Do Islamic Mortgages Differ From Conventional Ones?”

-

What is the primary difference between Islamic mortgages and conventional mortgages?

- Islamic mortgages operate according to Sharia law, prohibiting interest (riba), while conventional mortgages typically involve interest payments.

-

Are Islamic mortgages more costly than conventional mortgages?

- The overall costs can vary; while Islamic mortgages may have different fee structures, they do not include interest, which can affect total payments over time.

-

What are the common structures of Islamic mortgages?

- Islamic mortgages often use structures like Murabaha (cost-plus financing), Ijara (leasing), or Musharaka (joint venture), each adhering to Sharia principles.

-

Do Islamic mortgages require a significant down payment?

- Yes, similar to conventional mortgages, Islamic mortgages often require a sizable down payment, though the specific percentage may vary by lender.

- Can anyone apply for an Islamic mortgage, or is it limited to Muslims?

- While Islamic mortgages are designed to comply with Sharia, many lenders offer them to anyone interested, regardless of religious affiliation, as long as they agree to the terms.

Mushu, an experienced Saudi Arabia traveler and writer, shares insightful tips and spiritual reflections to enhance Hajj and Umrah journeys for fellow pilgrims. He has been to Makkah and Madina from 2016 to 2023 many times and his posts will reflect this.